2 MIN READ

Why Are We Not Seeing More Distressed CRE?

- Commercial Real Estate Insights

- Self Storage Industry

4 MIN READ

January 13, 2025

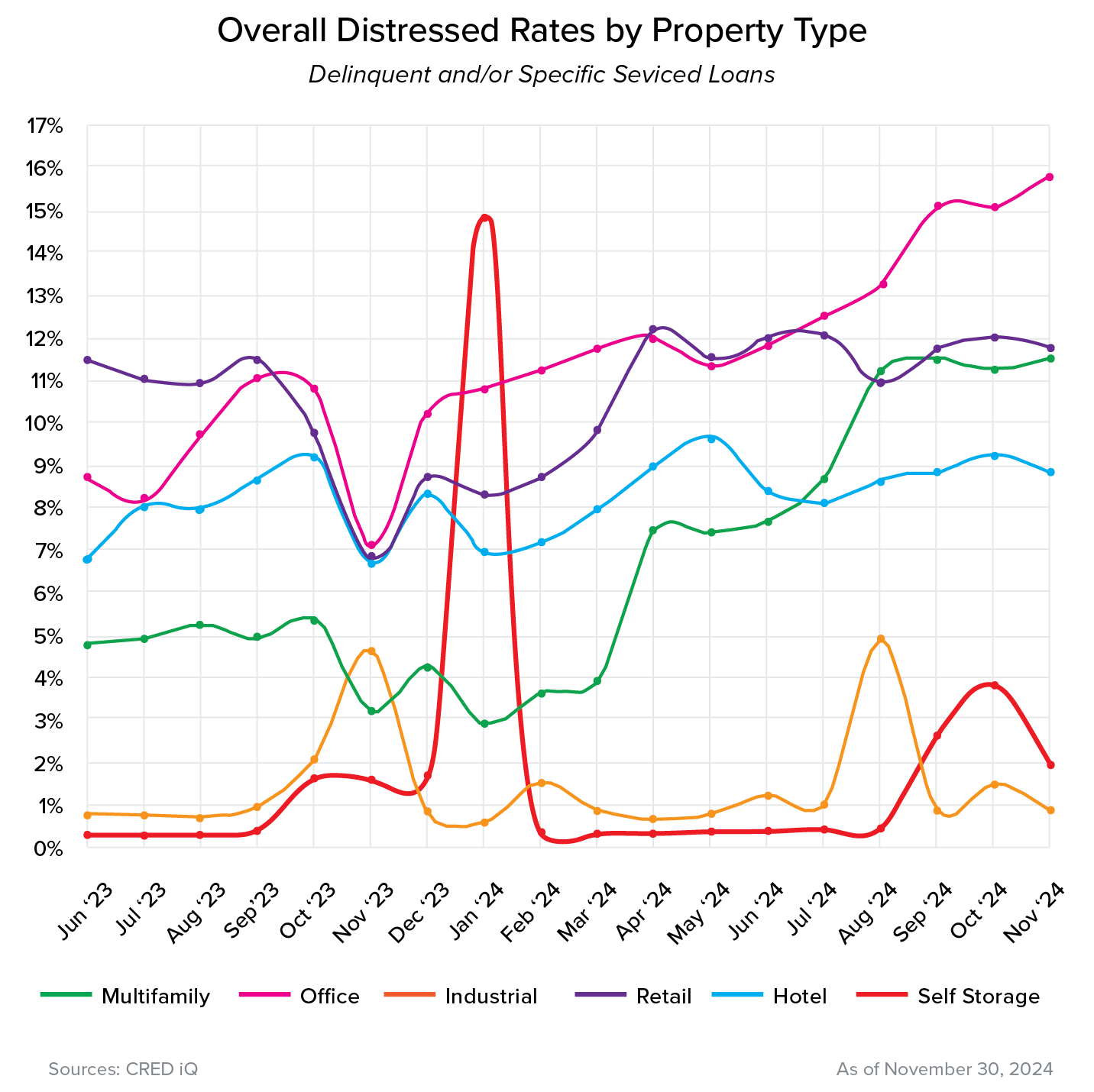

Distressed office loans have been a common theme of CRE over the last year. Slowly but steadily, almost every sector of commercial real estate has growing loan distress. Self storage and industrial show blips of distress, but look like nothing when compared to multifamily and office.

Construction debt is typically based on SOFR (Secured Overnight Financing Rate) rates which are closely tied to the Federal Funds Rate. When the Federal Reserve started cutting rates in September of 2024, the SOFR rate went down in basic lockstep. The September peak was 5.38% and today we sit at 4.40%. That is a meaningful reduction for those of us heavy in construction debt tied to SOFR. In past blogs, I have highlighted how commercial construction has almost come to a halt; this is in no small part due to the SOFR rate expansion seen in 2024.

The 10-year Treasury Yield, the interest rate the US Federal Government pays to borrow money for a decade, is one of the key rates for commercial real estate borrowers. The 10-year was at 3.65% back in September of 2024 and today sits at 4.57%. It has aggressively gone up as the Federal Funds Rate has gone down.

It seems like there are two main drivers that have pushed the 10-year higher. First, recent economic data that is better than expected has diminished the prospects for a significant number of rate cuts in 2025. Second, consistent economic data suggests we have not seen the end of the battle against inflation and we currently sit above the Federal Reserve’s target inflation rate of 2%. All of this adds confusion to debt analysis. The consistent increase of distressed commercial real estate is in no small part tied to the higher long term interest rates.

If rates don't come down making real estate financials perform better, “Plan B” will be to hold investments until demand exceeds supply and rental rates increase. This will happen, but the timing is uncertain. For some asset classes, this might happen sooner because of the remarkable downturn in construction, depending on their locations.

Looking at CRED IQ’s chart of overall CRE loan distress, there is a disturbing spike in self storage distress around January of 2024.

There is a story behind this spike. The Smart Storage portfolio in NYC was in the process of executing an extension option when it was flagged as distress. Bottom line, it was a “false flag” that is not a true reflection of distress. The extension is now complete, taking their debt into 2026. This validates the theory that self storage is one of the best performers through all cycles of real estate.

LOAD MORE

2 MIN READ

5 MIN READ

2 MIN READ

LOAD MORE