2 MIN READ

Fearing Losses, Banks Are Quietly Dumping Real Estate Loans

- Commercial Real Estate Insights

6 MIN READ

March 17, 2025

|

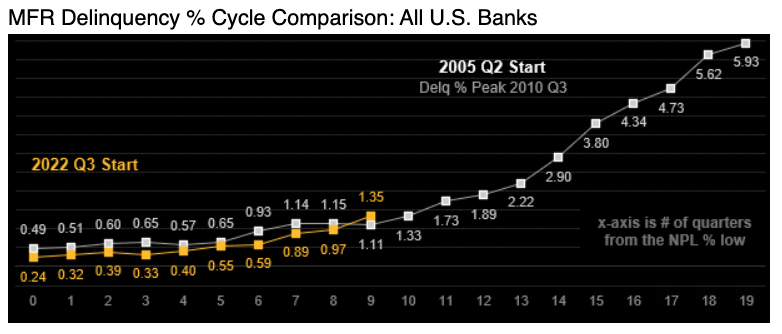

Understanding the Current State of Delinquent Real Estate: Are We in Big Trouble? Given the current trajectory of multifamily loan defaults, should we expect them to continue to follow the pattern set between 2007 and 2010? Looking only at the historical trends, it's hard not to conclude that defaults could get worse. Alarming Delinquency Rates Given these significant trends in defaulting loans, this isn't a story we hear about every day. During the Great Financial Recession, banks were seizing defaulting properties daily and moving quickly to get them off their balance sheets, even if it meant a loss for the bank. Today, however, the narrative seems quieter. The chart below compares multifamily loan delinquencies over the past couple of years with the beginning of the GFC. Interestingly, the delinquency statistics for multifamily properties closely mirror the trend between 2005 and 2007. During that period, a lot of other negative financial news was being reported as defaults rose. Bear Stearns collapsed in Q1 2008. The Federal Reserve took control of Fannie Mae and Freddie Mac in Q3 2008. Lehman Brothers filed for bankruptcy in Q3 2008. These events marked the onset of one of the most severe economic downturns in recent history. |

|

Source: BankRegData.com |

|

Considering the current trajectory of multifamily defaults, should we expect them to continue to follow the pattern set between 2007 and 2010? While I can’t provide an economist's viewpoint, I believe the multifamily asset class is in a very different position today compared to 2007. Limited New Supply: Since 2024, there has been little new multifamily construction. While some submarkets may have excess supply or an oversaturation of high-end units, the overall market did not experience the gross oversupply that would have created a hangover for a few years. Single-Family Homes vs. Renting: The current market conditions make purchasing single-family homes less attractive compared to renting. In fact, we are selling fewer homes today than we did at the lowest point of the Great Financial Crisis (GFC). Banks’ Approach to Borrowers: Unlike during the GFC, when banks felt pressured by the Fed to foreclose and rid themselves of bad loans aggressively, today’s banks are more open to working with borrowers. They are willing to listen to borrowers’ plans and consider discounts or loan modifications directly to the borrower's benefit. |

|

Source: BankRegData.com |

|

While the data on delinquency rates suggests a troubling trend in multifamily real estate, it's impossible to say the future will play out like it did post-GFC. With limited new supply, a challenging single-family housing market, and banks willing to collaborate with borrowers I don't expect defaults to look like they did The Last Time Around. |

LOAD MORE

2 MIN READ

2 MIN READ

2 MIN READ

LOAD MORE