4 MIN READ

4 MIN READ

A Contrarian Play

October 18, 2025

Today's Advantages in Real Estate Development

Having just returned from a capital conference, Tabor to be specifc, I experienced a uniqueness in that the room was filled with managers and investors whose primary focus wasn’t real estate. Typically, the conferences we attend are centered entirely on real estate, with all participants, including managers and investors, deeply invested in all things rel estate. At this conference, the real estate managers were spartan, which is not a bad thing if you have a standout strategy.

Most of our meetings were with investors for whom real estate wasn’t their main priority. This is different from what we’re accustomed to, as most of our family office investor network is heavily real estate-focused. A recurring sentiment I heard from these families was: “Real estate is a tough investment today.” And why is that? Assets acquired in 2021 and 2022 have decreased in value, generated less cash flow than expected, and offered limited liquidity options. Refinancing often requires capital calls to meet a bank's debt service requirements. These concerns are all valid to some degree depending on the asset.

Real estate is inherently a contrarian business. When others are buying, it’s time to sell—and when others are selling, it’s time to buy. The actions you take today are what position you for success when the market cycle picks up again.

There are significant advantages to pursuing development when the real estate market has uncertainty—advantages that simply don’t exist when the real estate market is booming:

Most of our meetings were with investors for whom real estate wasn’t their main priority. This is different from what we’re accustomed to, as most of our family office investor network is heavily real estate-focused. A recurring sentiment I heard from these families was: “Real estate is a tough investment today.” And why is that? Assets acquired in 2021 and 2022 have decreased in value, generated less cash flow than expected, and offered limited liquidity options. Refinancing often requires capital calls to meet a bank's debt service requirements. These concerns are all valid to some degree depending on the asset.

Real estate is inherently a contrarian business. When others are buying, it’s time to sell—and when others are selling, it’s time to buy. The actions you take today are what position you for success when the market cycle picks up again.

There are significant advantages to pursuing development when the real estate market has uncertainty—advantages that simply don’t exist when the real estate market is booming:

-

Leverage with Land Sellers – This is a rare, once-in-a-cycle opportunity. For developers, this translates to more time to close deals and the ability to negotiate prices below asking. Contrast this with 2021/2022, when land sellers held all the cards.

-

Construction Pricing – Construction costs can decrease. While this might not always mean lower material or labor costs, subcontractors will reduce their profit margins to secure work. Though this trend may not apply to every market, we’re seeing it happen today in Texas and Florida.

-

Banks Looking to Deploy Debt – Banks face the challenge of limited loan payoffs, which restricts their ability to issue new loans. However, as interest rates decline and capital returns to the market, banks will become more aggressive in offering both construction and acquisition loans.

-

Decreased Competition - likely the most valuable of the advantages as we all know dumb deals happen when there is endless debt and equity and low interest rates make every deal work.

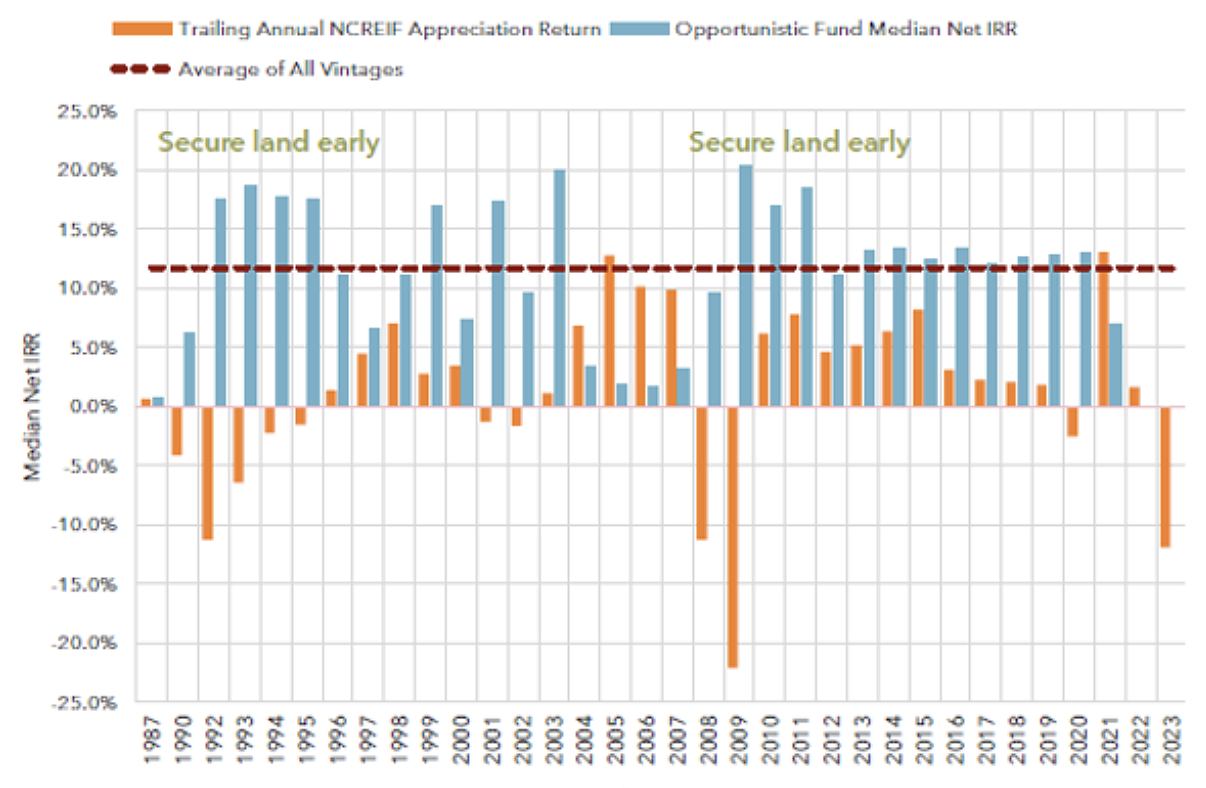

Source: Global Real Estate Investment Manager - Hines

No doubt there are serious challenges to development today, anyone actively developing could provide a laundry list. I recently came across a chart produced by Hines that reinforces the idea that opportunistic investments made during the late stages of a downturn—or the early stages of a market recovery—yield the highest returns.

It takes strong conviction to act when others are too cautious to take the risk.

See More Posts

LOAD MORE

5 MIN READ

A Counter Argument to Decreases in Labor Costs

- Commercial Real Estate Insights

- Self Storage Industry

3 MIN READ

Navigating the Risks of Preferred Equity in Commercial Real Estate

- Self Storage Industry

LOAD MORE