4 MIN READ

Is a Home Remodeling Boom on its Way?

- Real Estate Development

- Self Storage Industry

3 MIN READ

January 27, 2025

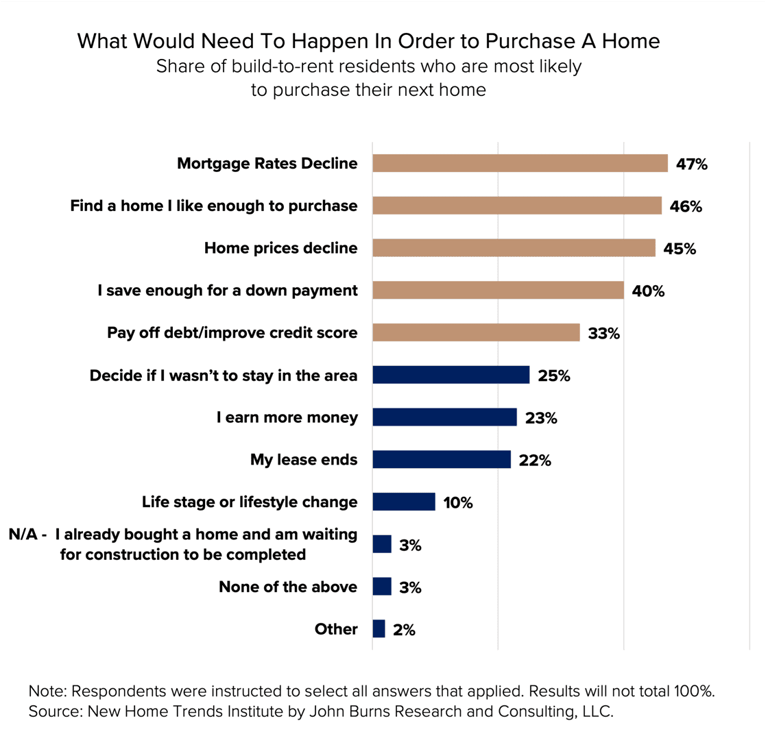

John Burns Research & Consulting just released the survey results of a questionnaire about renting versus owning homes. The most insightful results came from the question, “What would need to happen in order to purchase a new home?” Of the top five reasons, four are either out of, or somewhat out of, the potential home buyers' control.

Starting with what is out of a home buyer's control:

Arguably, within a home buyer’s control:

Totally in the home buyer's control:

Saving for a down payment or reducing personal debt just takes time, and for those lucky enough to receive a gift from a parent, that can also take time. Significant progress on saving a down payment or paying down debt usually requires a change of jobs or a promotion, resulting in increased wages. That all takes time, which is why it is arguably as much in the home buyer's control as it is out of the home buyer's control.

I would bet that the one factor solidly in the home buyer's control, “finding the right home,” has more to do with affordability than any other factor. The “right home” must have the “right price,” which is affordable. For younger homeowners, especially first-time home buyers, affordability comes in the form of a longer commute or a relocation to another city.

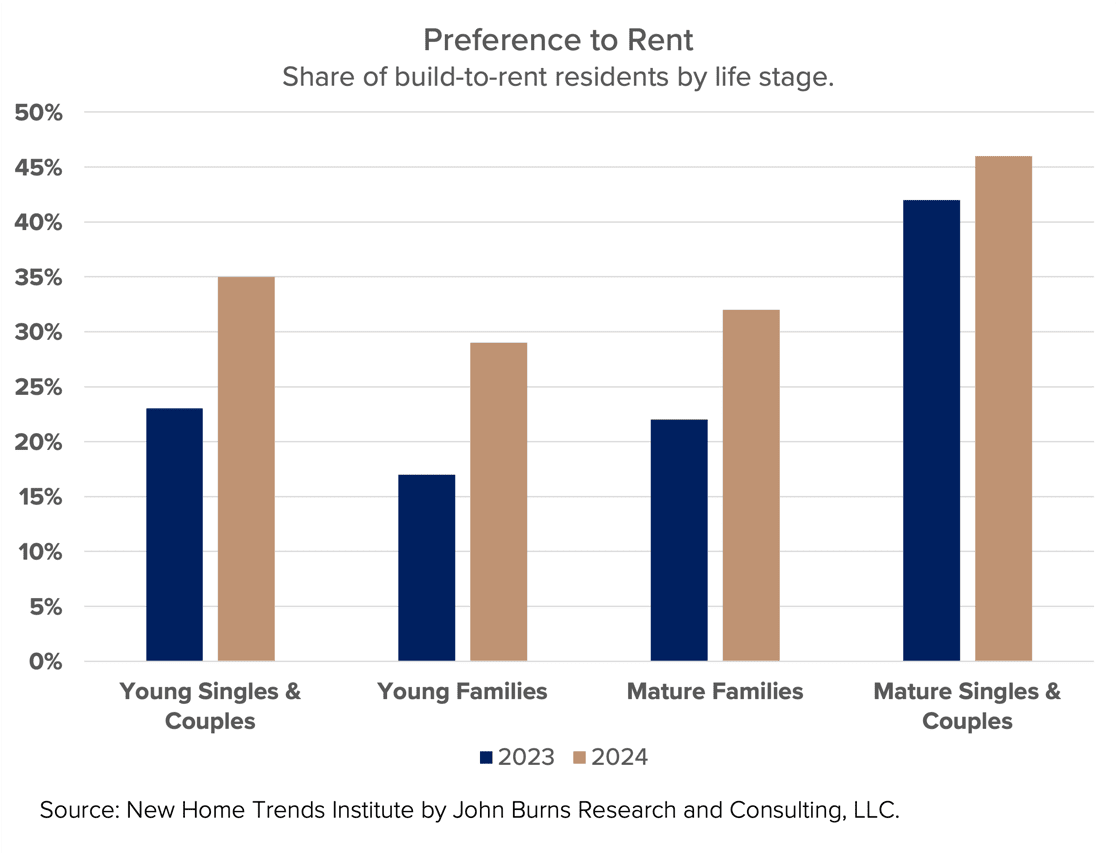

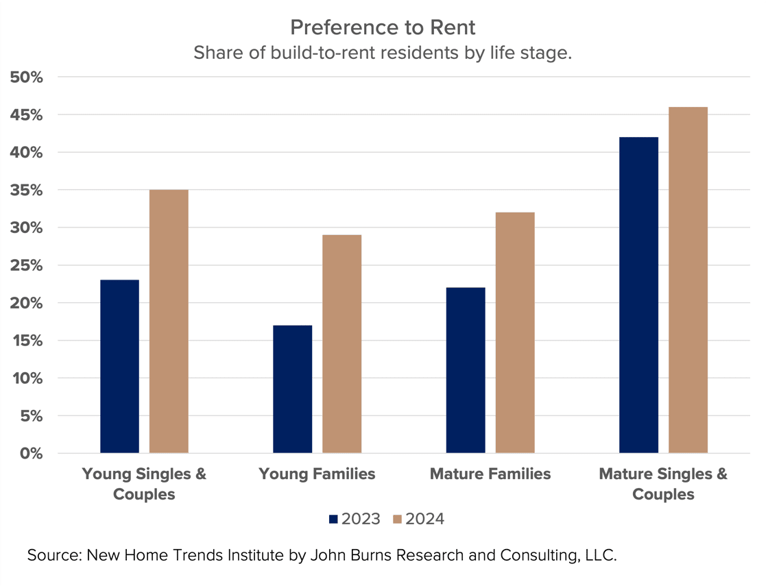

The survey was oriented around the build-to-rent asset class filling a significant need for younger renters, especially with families. Young families' preference for build-to-rent nearly doubled from 2023 to 2024. This indicates how bad potential buyers feel about purchasing a single-family home and the harsh reality that many factors are out of their control.

LOAD MORE

4 MIN READ

4 MIN READ

4 MIN READ

LOAD MORE