4 MIN READ

The Roll Up: DXD Capital opens Public Storage-branded store in Miami metro

- Self Storage Industry

4 MIN READ

November 08, 2025

Self storage is incredibly vulnerable to an oversupply of new construction, creating too many competing units for a finite market. The vulnerability is heightened during the lease-up period, which lasts 18-30 months after construction completion, especially for a new facility. Lease-up is a very vulnerable time for self storage developers. Whereas other asset types may have many levers to pull to increase performance, self storage has one lever…cut price. Increasing the marketing budget can help to some extent, but since self storage is a need-based service, no amount of advertising will create demand if customers simply don't need it. When people need storage, they usually need it immediately.

Take hotels, for example, they do have the price lever but they also have the ability to change brand flags or replace their whole management team to increase performance. Despite what self storage operators believe, there is no brand loyalty in our business. Hotels are just the opposite where loyalty is everything. People do dumb things to get their loyalty points, like stay in a shithole Marriott because their status gets them a waffle and microwave egg breakfast in the morning. Hotels can remodel rooms, they can add exercise equipment, and change up their food offerings. There are almost endless opportunities to win business.

Self storage has an Achilles heel, too much new construction in the submarket. It’s not interest rates, economic conditions, or government spending that pose the greatest threat to our business. The real issue arises when too much is built simultaneously, leading to declining rental rates and longer times to facility stabilization. Don’t get me wrong—higher interest rates are challenging, but they’re not fatal.

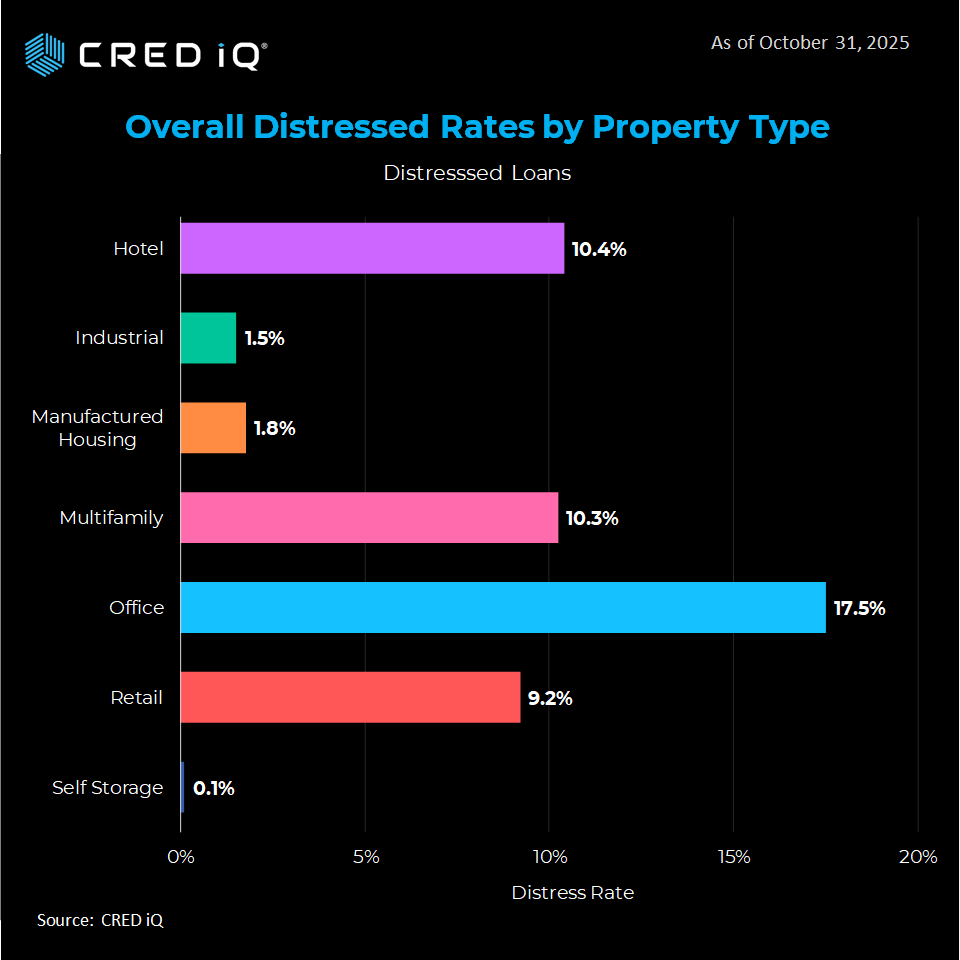

Looking at CRED IQ’s CMBS commercial real estate loan analysis, only 0.1% of self storage loans are currently in distress. It’s clear that external factors, such as slowing job growth and reduced government spending, have had little to no impact on the performance of the self storage sector. Additionally, while certain markets may be and remain oversupplied for years, the industry as a whole is not facing oversupply issues.

For the real estate industry to function effectively, we depend on lenders like banks, insurance companies, and CMBS providers—all of them, consistently. Unfortunately, many lenders are dealing with distressed loans, just not in self storage.

LOAD MORE

4 MIN READ

1 MIN READ

1 MIN READ

LOAD MORE