4 MIN READ

4 MIN READ

The 50-Year Mortgage: Lifeline or Illusion?

November 15, 2025

The 50-year home mortgage is an intriguing concept with the initial impression that it could be very good for home buyers who have been priced out of the market. The notion of someone staying in their home for 30 years, and by the end of their working career, after the kids have moved out, having a nice little nest egg is appealing.

However, in 2024, the average American stayed in their home for 11.8 years. In 2005, the average home tenure was just 6.5 years—a striking difference that influenced where today buyers are being priced out of the market and potential sellers are locked into a 3% interest rate that they may never see again in their lifetime. The longer interest rates remain high, the longer Americans will stay in their homes.

So, how good or bad is a 50-year mortgage vs a 30-year mortgage?

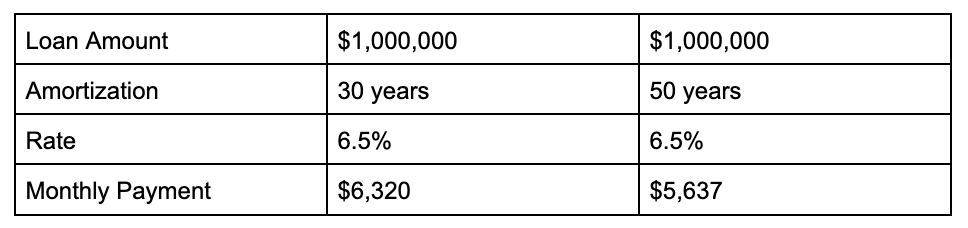

That's a monthly payment reduction of $683 and an annual savings of $8,196—not insignificant, but not exactly transformative.

Looking at it from another perspective, if your maximum affordable monthly payment was $6,017, with a 50-year mortgage, you could qualify for a loan of $1,065,000. Again, nice but not a game changer.

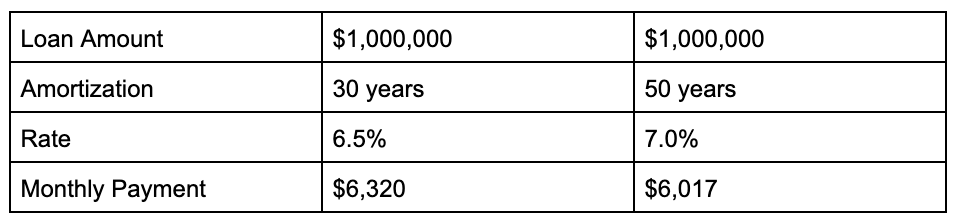

At first glance, this seems reasonable. However, as with most things, the details matter. It's conceivable that the interest rate on a 50-year mortgage would be higher than that of a 30-year mortgage. The borrower would build significantly less equity—particularly in the first 10 years—making it resemble an interest-only loan.

That's a monthly savings of $303, or $3,636 annually. Looking at it from this perspective, the benefit of a 50-year mortgage is minimal.

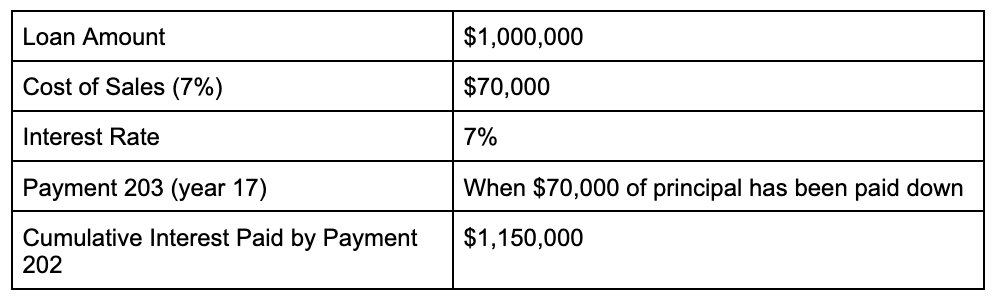

Another aspect that many first-time or even repeat homebuyers often overlook is the cost of selling a home. Let’s estimate that at 7%—though it might be closer to 5% now, as sellers are no longer expected to cover both their own broker’s fees and the buyer’s. On the other hand, it could climb to 9% when you consider newly implemented mansion taxes (a trend we’re likely to see more of in the future).

These numbers are shocking. Homeowners will now rely solely on value appreciation. While home appreciation has historically been favorable for U.S. homeowners, it remains unpredictable, and many homeowners need to sell in times of stress when the market has deteriorated.

See More Posts

LOAD MORE

2 MIN READ

Median Price of Used Homes Eclipses New Homes

- Self Storage Industry

LOAD MORE