4 MIN READ

The Most Overused and Unreliable Self Storage Underwriting Metric

- Self Storage Industry

4 MIN READ

March 24, 2025

|

Eliminating property taxes for homeowners isn’t a concept I’ve heard often. Given Florida’s history as a pro-growth state that consistently seeks to improve its economic appeal, it’s not entirely shocking that such a bold proposal would surface there. What did surprise me, however, is that this tax cut would come in addition to Florida already not having a state income tax. Alongside Texas, Nevada, Tennessee, and a few others, Florida has become a magnet for high earners—and, by extension, the businesses and jobs they bring with them. |

|

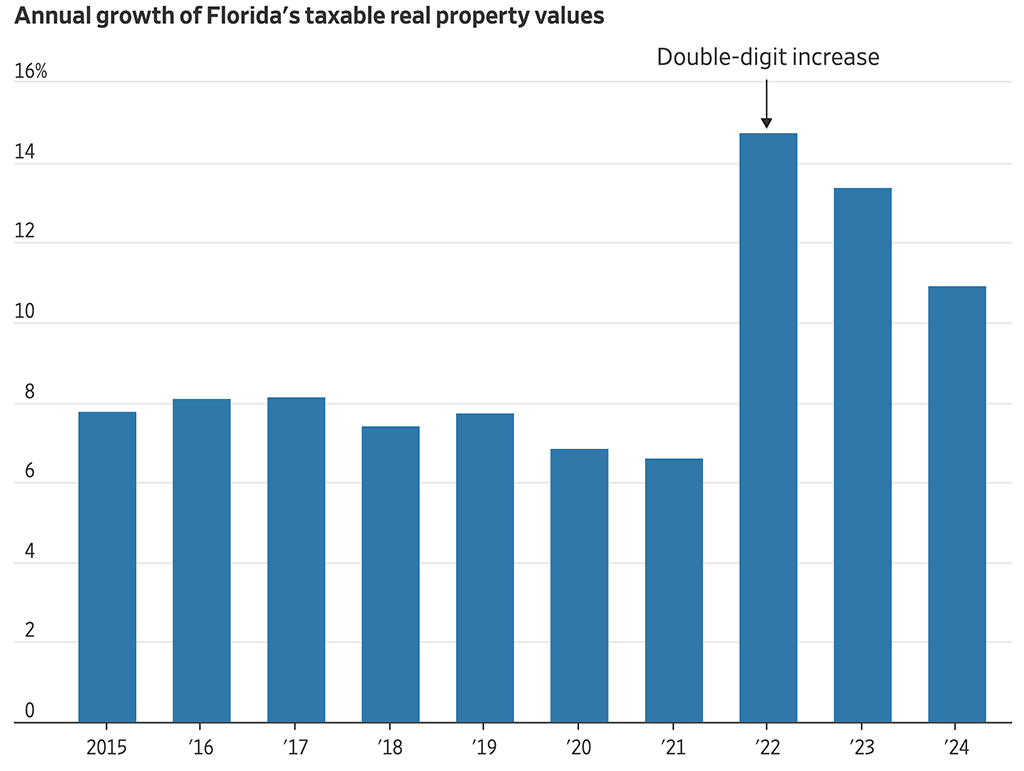

During the pandemic, Florida emerged as one of the biggest winners of the relocation trend across the U.S. This surge in population drove up home prices as demand far outpaced the supply of new home construction. From 2020 to 2024, the compounded increase in taxable home values in Florida was 65%. This means the state is theoretically collecting 65% more in property tax revenue now compared to five years ago—a significant windfall for a state already benefiting from substantial economic tailwinds. That said, the article doesn’t shed light on how Florida plans to fill the revenue gap if property taxes are eliminated. In fact, it suggests that state policymakers themselves have no clear plan. Reducing government programs and spending may prove challenging in a state with a disproportionately large retiree population—many of whom rely heavily on government services, especially in retirement. This article makes me think of one thing: Florida may turn to commercial real estate to help bridge the tax gap. In Florida, like everywhere, there are significantly more homeowners or aspiring homeowners who vote than commercial property owners. We look at self storage investments in states and specific counties across the US where property taxes can make or break the investment. We might be adding Florida to that list. |

LOAD MORE

4 MIN READ

2 MIN READ

LOAD MORE