4 MIN READ

The Roll Up: DXD Capital opens Public Storage-branded store in Miami metro

- Self Storage Industry

5 MIN READ

June 26, 2023

Self Storage development is as hard as it gets right now.

After a period of low interest rates, reasonable construction costs, and surging self storage demand (driven by COVID), we now sit in a much different environment.

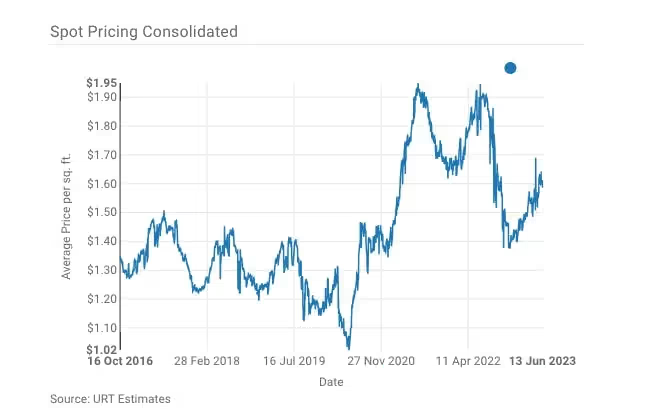

Here's the current landscape of the self storage market:

On top of this, regional banks, who are the predominant suppliers of construction financing in the commercial real estate sector, have almost effectively stopped lending to most developers.

Why?

3 reasons, mostly balance sheet-oriented issues:

So, with all of the issues mentioned above, why do we still want to develop?

It has to do with what happens after these types of conditions hit the storage market last.

During the last major recession (2009) we saw a similar contraction in debt availability, which subsequently shut down the development of new storage facilities (below 2006 --> 2012).

What we know however is that storage demand is resilient, the most consistent out of any of the real estate asset classes.

So what happens when supply stops ❌ and demand continues to grow 📈?

Well, storage fundamentals benefit ⬆️

Below is a chart of the occupancy and revenue growth for Public Storage from 2010 to 2016, and as you can see occupancy went from 88% → 94% and revenue growth accelerated by 50% from below 4% to above 6%.

While each cycle has its own nuances, the same principles carry forward.

We are entering a period where supply is shrinking, but we know that demand continues to flourish.

If you can find a way to develop in spite of the headwinds, then you are creating value.

Finding a way to develop is what we are focused on daily, and why we are excited about the years to come.

LOAD MORE

4 MIN READ

1 MIN READ

3 MIN READ

LOAD MORE