4 MIN READ

3 MIN READ

Buy Now, Pay Later: Helping Americans Make Stupid Decisions

Sep 6, 2025 10:00:00 AM

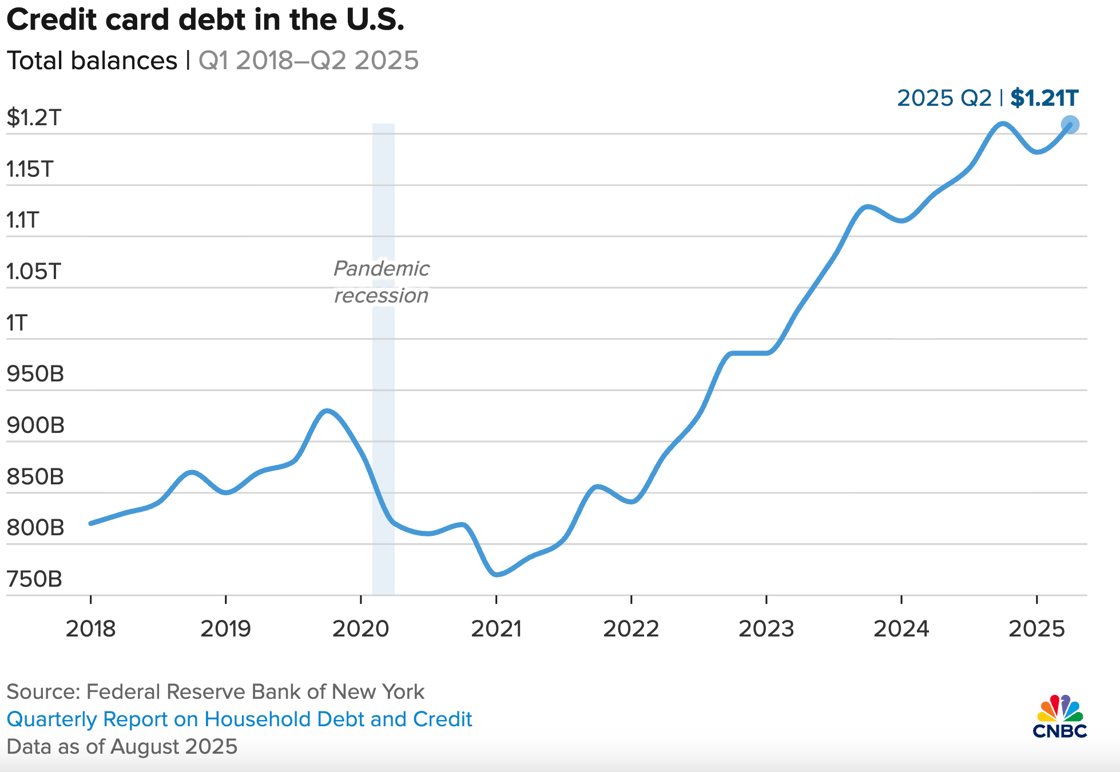

One of my key indicators for evaluating the state of the U.S. economy is the level of consumer credit card debt, which has surged drastically since 2021, following the Federal Reserve's decision to scale back pandemic-related economic assistance. Over the past four and a half years, credit card debt has risen by more than 50%. It’s difficult to argue that this sharp increase is anything but a troubling sign for the economy. To put it into perspective, that’s approximately $5,300 in credit card debt for every American aged 18 to 65. With an average interest rate of 22%, it’s easy to imagine the staggering amount being drained in interest payments—not to mention the rising cases of rampant credit card fraud.

There is, however, a "solution" to this issue—though one that introduces even greater challenges for U.S. consumers: the rapid growth of Buy Now, Pay Later (BNPL) fintech services. For those who have maxed out their credit cards, services like Klarna allow deferred payments, letting you split your purchase into four interest-free installments. But if you’re unable to pay on time, don’t worry—Klarna has a "solution" for that too: a hefty interest rate of 36%. Compared to this, credit card rates almost seem benevolent.

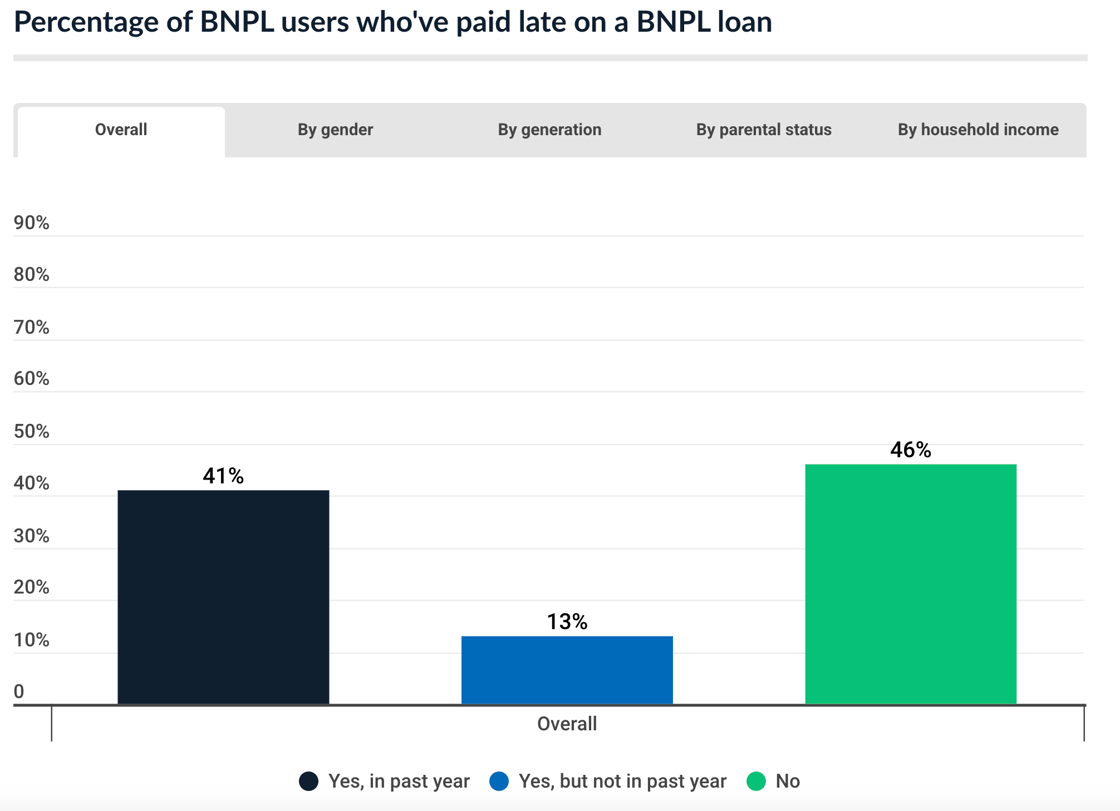

BNPL services are widely available at popular retailers, including luxury brands like Louis Vuitton and even the TikTok Shop. These are prime examples of purchases that, if you can’t afford them outright, you probably shouldn’t be making. Why have the BNPL services exploded? Simple, 41% of users were unable to pay on time.

LendingTree.com, "BNPL Tracker: 41% of Users Late in Past Year..."

This type of financial service only worsens the situation for Americans who already struggle to manage their spending. It gives them yet another harmful way to delay reality.

See More Posts

LOAD MORE

4 MIN READ

Navigating Real Estate Debt Challenges in the Self Storage Market

4 MIN READ

The Current State of the Self Storage Market: June 2023

LOAD MORE