"The Property Tax System Is Breaking—and Ohio Might Be Ground Zero"

- Realtor.com, Getty Images

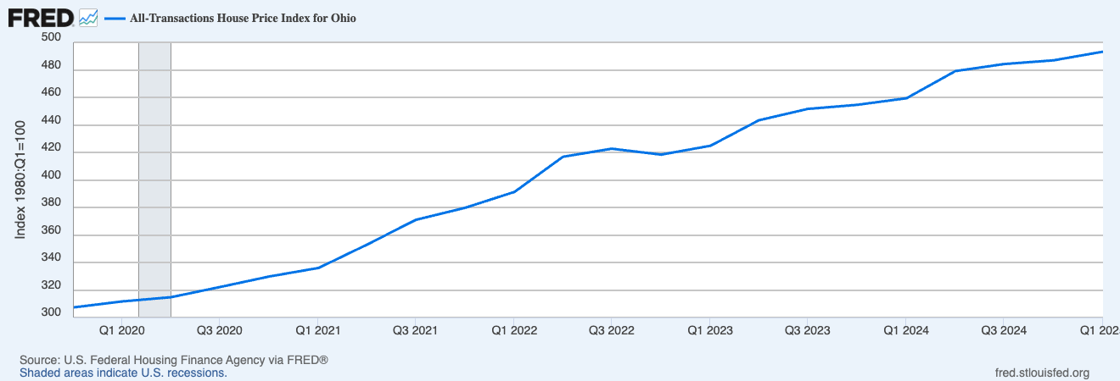

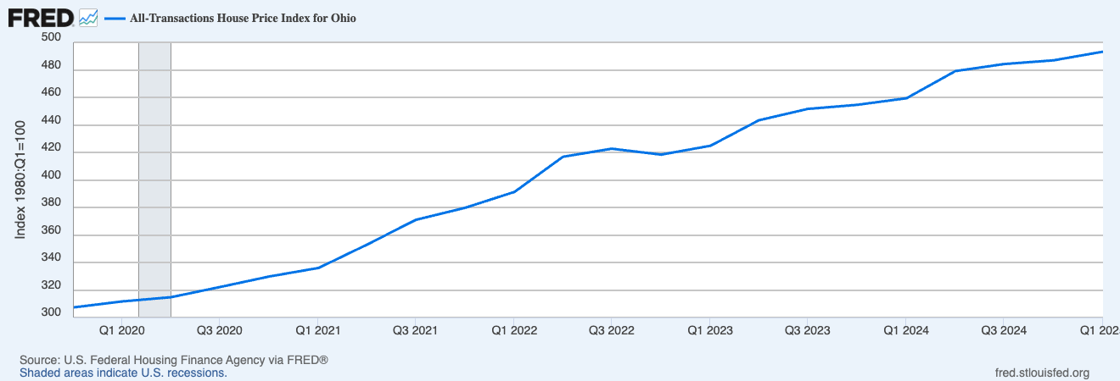

Real estate taxes are becoming a significant hurdle in the fight for homeownership. A recent article highlighted the situation in Youngstown, Ohio, where one in three homeowners is behind on their property taxes. This reflects multiple failures: a breakdown in tax policy, economic challenges, and issues with affordability. Many Americans are now facing unexpected financial strain due to property tax reassessments spurred by the housing boom during the pandemic. In Ohio, for example, properties are reappraised every six years. Data from the Federal Reserve Bank shows a staggering 68% increase in property values over that period—a shocking adjustment for any homeowner to absorb.

Source: fred.stlouisfed.org

This trend isn’t isolated to Ohio. Across the United States, similar stories are unfolding, except in states that limit annual tax increases. Take California, for example: Proposition 13, passed in 1978, restricts property tax increases to just 2% per year. While this cap doesn’t keep pace with actual home appreciation, it helps homeowners manage taxes as long as they remain in their homes. However, when a property is sold, it becomes eligible for a full reassessment, and the new buyer bears the brunt of the tax hike. In states like California, where the purchase price must be disclosed, tax assessors can pinpoint a home's market value with precision.

These escalating property taxes, combined with high interest rates and rising insurance costs, paint a challenging picture for homeowners. When property taxes spiral out of control, voters inevitably make their voices heard at the ballot box—and politicians take notice.

When governments look to fill budget gaps, commercial real estate often becomes the target. A $20 million office building doesn’t have a vote, but the homeowner of a $200,000 home does. Maybe two or three votes, making it clear where the tax burden will fall. Homebuyers often overlook the impact of property taxes when assessing a home’s affordability, but developers can’t afford to make that mistake. Real estate taxes represent a major expense, and we must anticipate potential "tax shocks" to ensure the success of a project.

Property taxes can be a real headache, but they’re solvable. Our job is to prepare for and understand worst-case scenarios when it comes to unpredictable costs like taxes. With smarter underwriting and sensible reassessment fixes, we can absorb tax risk and keep deals moving forward.