16 MIN READ

Self-Storage Development and Zoning Activity: July 2023

- Self Storage Industry

6 MIN READ

May 16, 2025

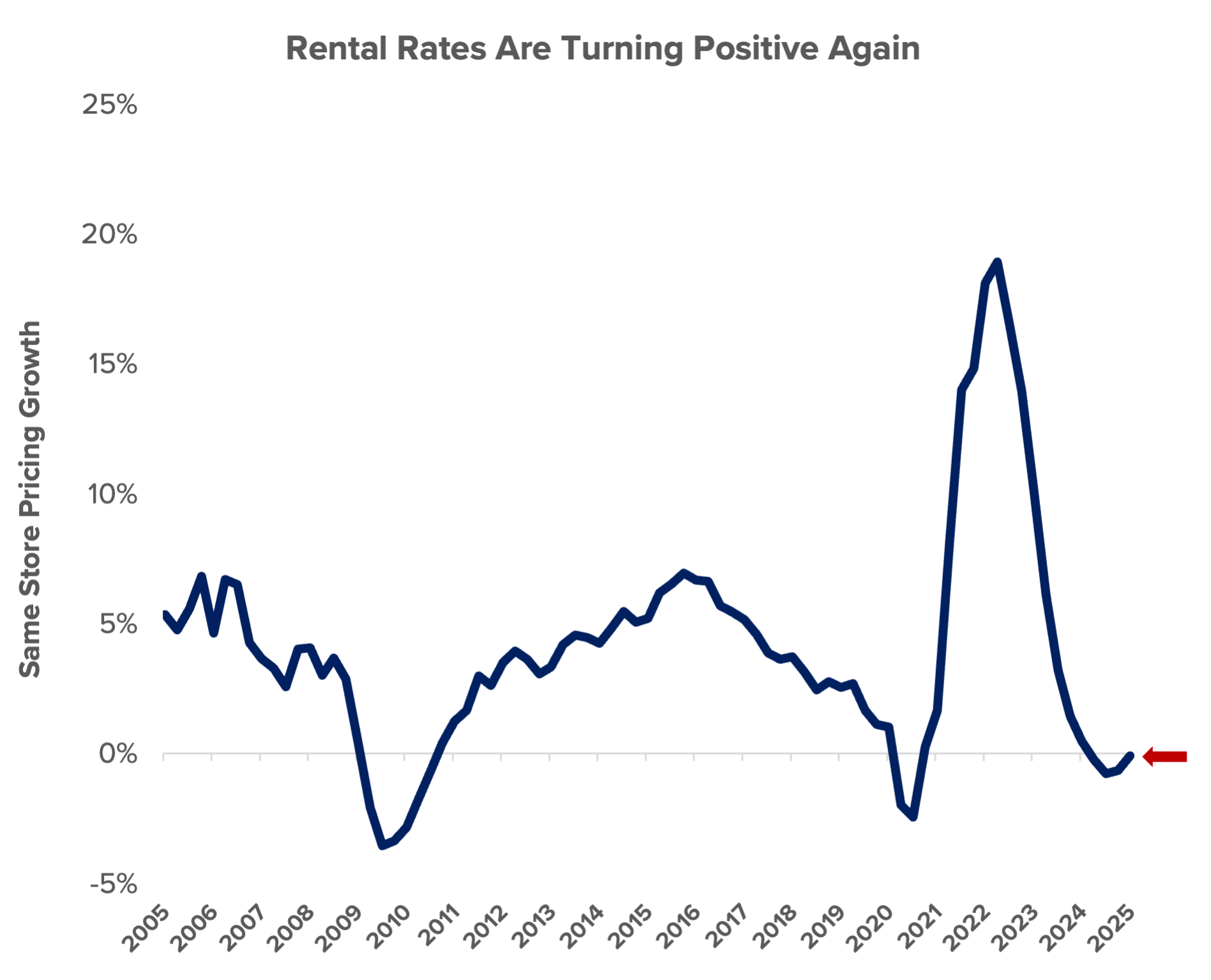

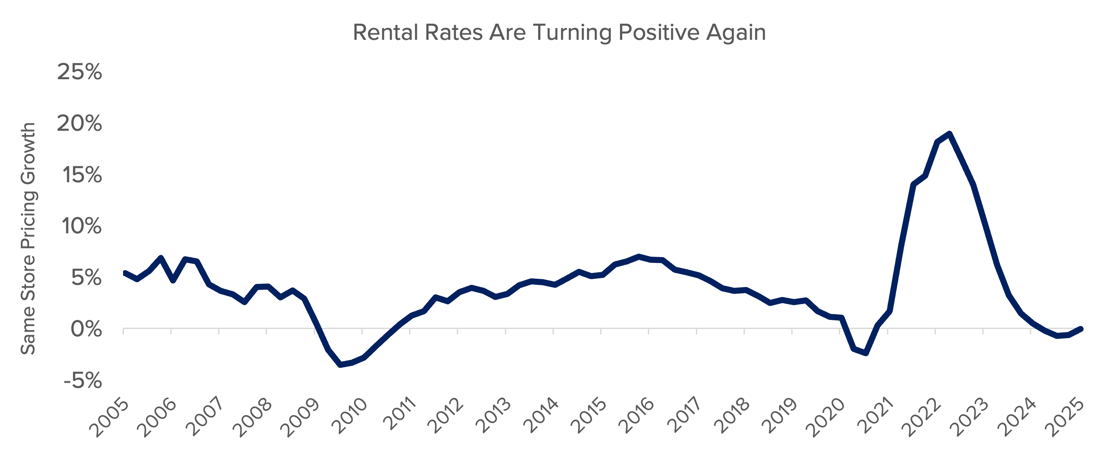

Source: Public Storage, Extra Space Storage and CubeSmart Financial Disclosure, DXD Capital

Why It Matters

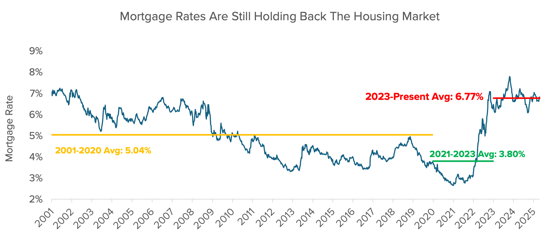

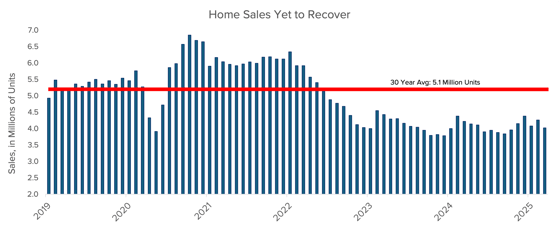

We may be entering a unique period in the storage cycle with pricing stabilizing, customer demand returning to baseline, and new supply slowing down. What’s unique here is high mortgage rates continue to constrain the transaction volume in the housing market, as home sales remain near historical lows.

The implication being that if home sales were to accelerate, that would be an additional tailwind for demand.

|

Source: Federal Reserve Economic Data & DXD Capital

|

Source: National Association of Realtors via Mortgage News Daily, DXD Capital

We believe that Q1 2025 will go down as the quarter where the momentum in the sector turned. With developers still mostly on the sidelines, we could not be more bullish on the prospect of building new sites.

LOAD MORE

16 MIN READ

3 MIN READ

1 MIN READ

LOAD MORE