1 MIN READ

Self-storage space is down and rents are way up

- Self Storage Industry

3 MIN READ

October 25, 2025

Institutional investors are taking a step back from commercial real estate. For the first time in a decade, they reduced their allocation to the sector. Why? There is no doubt a hangover from investments made in 2021 and 2022, the height of the pandemic, fueled by cheap debt and consumers flush with the government's money. In the trenches of capital raising, we have seen this play out for the last two years. There are many institutional investors who have money to invest today, sitting on the sidelines, licking wounds on investments that have lost value or need additional capital to keep going.

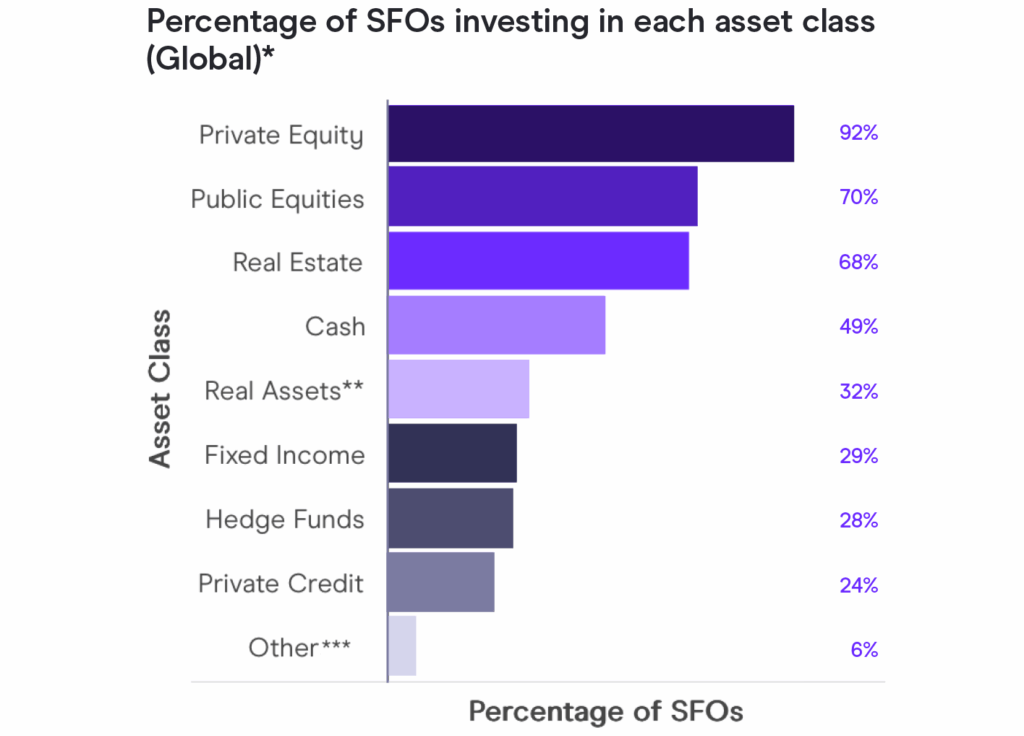

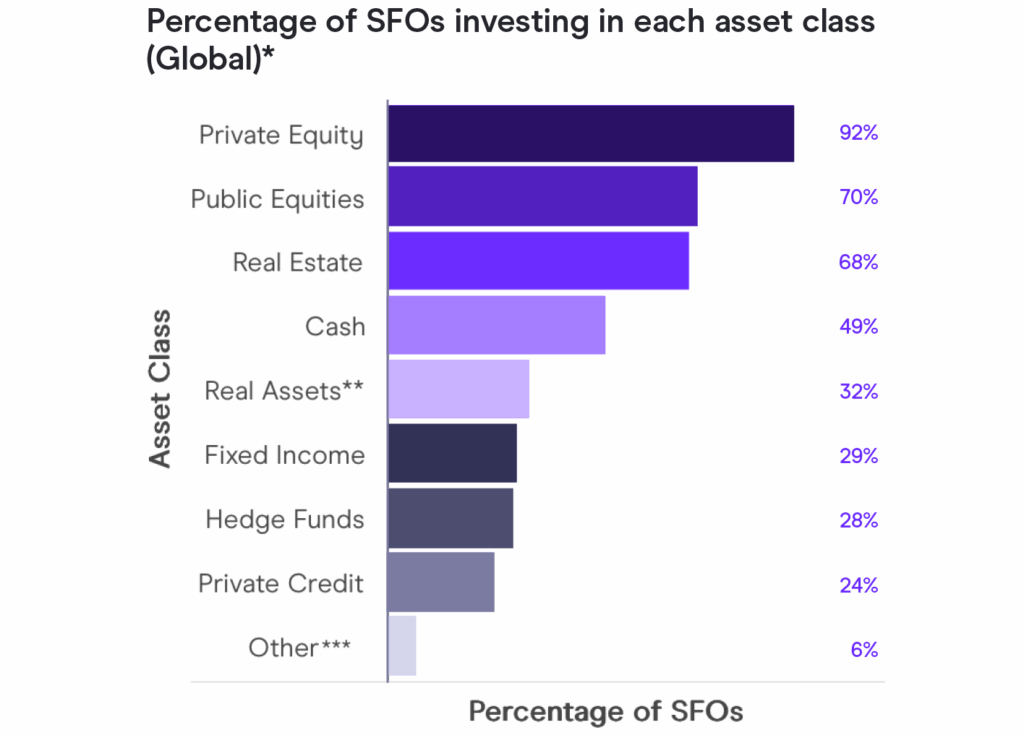

What are the ramifications of this for private equity investors like DXD Capital? Other investors get the opportunity to step into the void left by institutions. The most likely candidate is the family office. Both US and international family offices have done extremely well with their investments since 2020. Whether it's venture capital, public equities, non-real estate private equity, debt funds, or crypto, there was a tremendous opportunity to make money during and post-pandemic, and many of them took full advantage of that opportunity.

They also invested in the same real estate that the institutions did, however, there is a big difference in terms of investment horizon. Most institutional investors have finite time horizons, the goal is to recycle capital every three to seven years. That means that real estate investments made in 2021 that are not performing need to be exited and losses taken. The mindset of the family offices is different. They are more likely to hold on, to ride out the waves. They have been to this movie a dozen times, they know the pendulum always swings back to positive, and the fatal flaw of real estate is the need to exit an investment at an inopportune time. They are also not taking their foot off the gas, continuing to invest when others will not or cannot. The deals that are getting done are good deals, with much less competition at terms much more advantageous than when real estate is rocking.

The family offices that are taking full advantage of THE CONTRARIAN PLAY, will emerge from this cycle as the big winners.

LOAD MORE

1 MIN READ

3 MIN READ

4 MIN READ

LOAD MORE