4 MIN READ

3 MIN READ

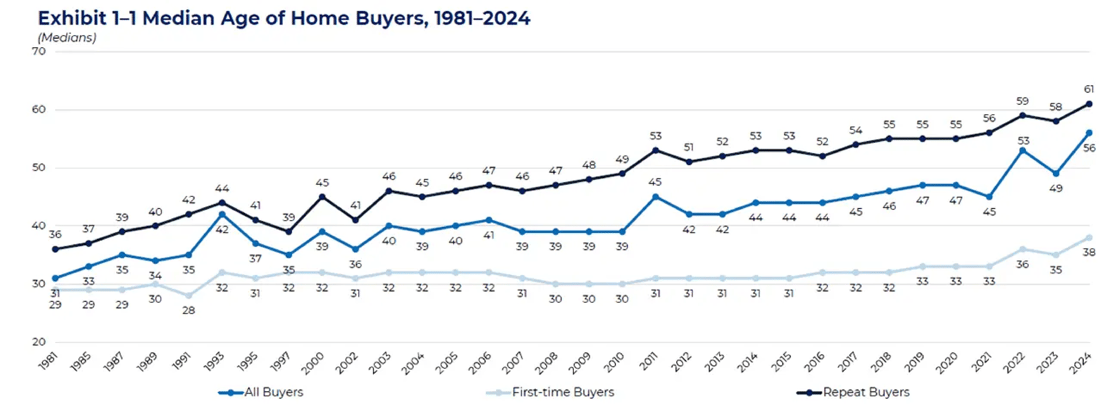

The Rising Age of First-Time Home Buyers

August 23, 2025

The average age of first-time homebuyers reached an all-time high of 38 years in 2024, compared to just 28 years in 1991. This marks a 35% increase over the past 33 years, equating to an annual compounded growth rate of approximately 1%.

Source: National Association of Realtors | 2024 Profile of Home Buyers and Sellers

At the onset of the pandemic in 2020, the median age for first-time buyers was 33. From 2020 to 2024, that figure rose by a compounding 4%—a significant jump compared to the 30-year trend.

What does such a shift mean?

Here’s some rough math: the increase in the average age of first-time buyers translates to approximately 7 million fewer homes being bought and sold. This means 8.9 million fewer commissions for real estate brokers, 8.9 million fewer closings for title companies etc. The ripples from this change are not insignificant for our economy.

With an average household size of 2.5 people, this also represents about 22.4 million Americans missing out on the opportunity to grow their wealth through the "forced savings plan" of homeownership.

On the flip side, this trend has led to 7 million additional rental homes. As Americans age, accumulate more wealth, and grow their families, they tend to seek larger spaces, fueling the growth of the single-family rental market. In fact, the rising median age of first-time homebuyers is arguably one of the most significant tailwinds driving this market. Unlike in previous decades, entire subdivisions are now being built specifically for single-family rentals—a property type that barely existed at scale before 2020.

For this trend to reverse, either interest rates would need to drop significantly, or home prices would have to fall dramatically. However, if either of those scenarios were to occur, it might indicate broader economic challenges, potentially making homeownership financially out of reach regardless of rates or prices.

See More Posts

LOAD MORE

LOAD MORE